Special Report: The Cost of Breast Cancer Care

Updated on June 1, 2025

Breast cancer treatment in the United States can be extremely expensive, even for those who have health insurance. In 2019, people paid higher out-of-pocket costs for breast cancer care than they did for any other type of cancer care — a total of $3.14 billion. 1

People with breast cancer often struggle because of lost income from having to take time off work and with health insurance and care-related costs they can’t afford. The bills and debt can pile up, causing some people to skip or delay recommended treatments. It’s not uncommon for the financial burden to last for years and to affect a person’s whole family.

In this Breastcancer.org Special Report, we spoke with experts and people diagnosed with breast cancer about the major causes of cancer care-related financial problems and the steps you can take to make costs more manageable.

When she was diagnosed with metastatic breast cancer in 2017 at the age of 38, Megan Rizzo-Canny was in shock. She’d just gotten her first-ever mammogram after finding a lump in her breast. She feared for her life and for how her diagnosis would affect her family. But she wasn’t worried about her finances or how she would pay for her treatment.

The mom of a then three-year-old and the main breadwinner for her household, Rizzo-Canny had a well-paying job at a large company in New Jersey. She and her employer agreed that she would continue to work full-time while she was undergoing treatment. However, several months later, just as she was completing chemotherapy treatments and preparing to have surgery, she was told her position had been eliminated. She would receive only two more weeks of salary and health insurance coverage.

“My family is still in debt and financially unstable five years after my breast cancer diagnosis because of loss of income and increased expenses,” Rizzo-Canny said, noting that she and her husband had to refinance their mortgage to help pay off credit card debt and that she lost her company-provided car when she lost her job.

“No one saves for cancer,” she said. “And it’s devastating to deal with financial problems on top of dealing with your diagnosis.”

For many people diagnosed with breast cancer, one of the unexpected side effects of treatment is a long-lasting financial burden.

The financial challenges of breast cancer care

Breast cancer is one of the most expensive types of cancer to treat. 2 And as the price of treatment continues to rise, people are shouldering more of the costs of their care than ever before. Many of them are paying more for health insurance, in the form of higher premiums, deductibles, co-payments, and co-insurance rates. The cost for certain treatments, particularly some cancer drugs, is so high that some people struggle to afford them even if they have health insurance. In addition, people receiving treatment for cancer:

face extra costs that health insurance doesn’t cover, such as for travel to and from treatment centers

may be earning a lower income than usual because they’ve had to take time off work or have lost their job during treatment

Because of these challenges, people with breast cancer may have trouble paying their bills and may have to use up their savings, go into debt, or make difficult trade-offs. Some people have to cut back on basics such as food and clothing so they can pay for cancer care. Managing costs has gotten even more difficult in the past couple of years for those whose jobs, income, and health insurance coverage were disrupted by the COVID-19 pandemic.

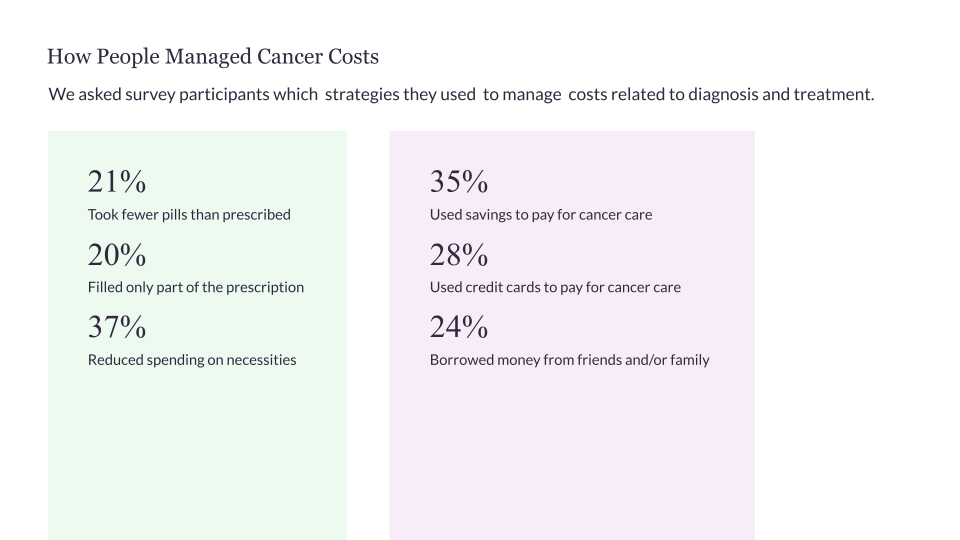

A 2022 Breastcancer.org survey of 1,437 people who live in the United States and were diagnosed with breast cancer in the past 10 years found that:

47% said their breast cancer-related out-of-pocket costs were a significant or catastrophic burden

37% reduced spending on basic necessities to cover treatment costs

Our findings are similar to those reported by the American Cancer Society Cancer Action Network (ACS CAN) in its 2022 survey of people diagnosed with a variety of cancer types. In the ACS CAN survey, 51% of cancer patients and survivors said they had debt related to their cancer care. Out of those who had debt, 45% delayed or avoided medical care for serious issues because of cost concerns.

Other researchers have found that people diagnosed with cancer are, on average, two-and-a-half times more likely to file for bankruptcy than those without cancer. 3

People who can’t afford their care are at risk for worse health outcomes, especially if they skip or postpone medical appointments, tests, and treatments as a result.

Financial problems can also drag people down emotionally, causing feelings of anxiety and shame.

“It’s very humbling to have cancer and to be struggling financially. You’re worried about losing everything you tried to build and maintain. Plus, your pride makes it hard to ask for help. You’re in a weakened state, and you’re embarrassed,” said Molly MacDonald, a breast cancer survivor and founder and CEO of Pink Fund, a national non-profit organization based in Michigan that provides financial assistance with household bills to people in the United States who are working while receiving treatment for breast cancer.

Almost anyone with breast cancer is potentially vulnerable to financial difficulties. However, certain groups are more at risk, and high costs are making existing health disparities worse. People who are diagnosed with breast cancer at a younger age, who have no health insurance, who have a lower income, or who are Black or Hispanic are among those most likely to experience financial hardship. Those with metastatic breast cancer are also at higher risk, in part because they have to receive treatment for the rest of their lives.

Five major causes of financial stress

We asked researchers, financial navigators, advocates, and people who’ve been diagnosed with breast cancer to tell us which causes of cancer-related financial problems they think are most common.

Here are the five biggest financial pain points that people with breast cancer and their families encounter:

1. Problems with health insurance coverage

Health insurance is supposed to protect you from high and unexpected medical costs, including costs related to a serious illness. But many insured people diagnosed with breast cancer in the United States wind up with out-of-pocket costs for their care that they can’t afford and other problems related to their coverage.

“Not having adequate health insurance coverage is the one thing that has the most impact overall on a person with cancer’s financial situation. A lot of patients are paying more than they need to be paying out of pocket because they have a plan that doesn’t cover the providers they want to see or their prescription medications, or that has a high deductible or out-of-pocket maximum,” said Joanna Fawzy Morales, a cancer rights attorney and CEO of Triage Cancer, a non-profit organization that provides free education on the legal and practical issues that affect people diagnosed with cancer.

At even greater risk of facing high costs are people who are uninsured. They may be responsible for the full cost of their care. In some cases, uninsured people may be charged higher rates for their treatment than people who have health insurance (since they do not automatically benefit from the discounted rates health insurance companies negotiate for patients). Uninsured people also are less likely to get access to needed care and more likely to have worse health outcomes. 4 Still, it’s common for an uninsured person’s healthcare team to connect them with a social worker (or some other individual or organization) who can help them get health insurance and access other resources that can lower their costs — such as a charity program at a hospital.

There are a few reasons why people diagnosed with breast cancer who have health insurance may still struggle with costs and access to care.

High out-of-pocket costs. Most private health insurance plans have an out-of-pocket maximum — a limit on the amount of money people have to pay themselves each year for healthcare services that are covered. In 2021, the average out-of-pocket maximum for someone with a private health plan was $4,272. 5

People with health plans also have to pay premiums (the fees, usually paid monthly, for staying enrolled in the plan) that don’t count toward the out-of-pocket maximum. The costs for breast cancer care are so high, people often reach their out-of-pocket maximum within the first three months of being diagnosed.

According to a 2022 Kaiser Family Foundation poll, half of adults in the United States don’t have the cash to cover an unexpected healthcare bill of $500, let alone to pay thousands toward meeting a typical out-of-pocket maximum if they were to be diagnosed with cancer.

Another problem for people receiving treatment for breast cancer is that the amount they contribute toward their deductible and out-of-pocket maximum resets (or returns to zero) every time their health plan renews (usually each January) or if they switch to a new plan. So if their treatment spans multiple years or if they change health insurance plans in the middle of treatment or in the middle of the year, they may have to pay the full out-of-pocket maximum more than once. 6

Cindy (name changed to protect privacy) was first diagnosed with breast cancer in 2016. For most of the years since her diagnosis, she and her family have had a health insurance plan with a deductible of about $6,000. One year, Cindy’s husband got a new job and the family had to switch health insurance plans in the middle of the year while she was receiving breast cancer treatment. That year, they spent almost $12,000 out of pocket to cover the full deductibles of the two different health plans. A single injection of a medicine called Xgeva (chemical name: denosumab), which a hospital billed for about $7,000, was the reason they had to pay the full deductible on the second health plan right away.

“We ended up paying a lot more than we would have if we had stayed on the same plan,” Cindy said.“The costs for health insurance are crazy, especially when you have a family. It’s still kind of mind-boggling to me that costs like that are allowed. It has caused us frustration and drained our savings.”

Not being able to stay covered. Depending on the type of health insurance you have, you might be at risk of losing coverage if you get a new job, if you move someplace else (even within the same state), or if your marital status changes. That’s why some experts say that health insurance plans in the United States aren’t portable enough.

“The majority of working people get their health insurance through their job. This puts them at a disservice if they develop cancer or any chronic disease because of ‘job lock’ — they feel like they can’t leave or worry about losing their job because they may not be able to get affordable health insurance if they do,” said Fumiko Chino, MD, an assistant attending radiation oncologist at Memorial Sloan Kettering Cancer Center in New York who studies the affordability of healthcare and patient costs.

Some people who are diagnosed with cancer end up losing their jobs and their health insurance benefits at the same time.

Like Megan Rizzo-Canny, Barbra Tugman, who lives in Massachusetts, was suddenly and unexpectedly let go from her job while she was receiving treatment for breast cancer. She immediately lost the health insurance she had through her job and had to scramble to get a new health plan within a matter of hours.

“I knew I needed good insurance and wound up signing up for a plan with very expensive premiums that were hard to afford given that I wasn’t working anymore and I don’t have a partner,” Tugman said. “Sometimes when I think about the situation my former employer put me in, I think: how could you do this to somebody?”

Besides job loss, some other reasons people may need to make a change to their coverage are because they:

were previously covered under a spouse’s health plan but can no longer keep that coverage because of divorce, the death of the spouse, or because the spouse left the job that provided the coverage

move to a different city or state (you may still have to find a new health plan if you move to a different region in the same state)

switch to working part time at their jobs (some employer-provided health plans are only available to full-time employees)

If you can no longer keep your current health insurance plan, there are a number of options that may be available depending on your individual situation. For example, one option may be to apply to continue your current coverage through COBRA (the Consolidated Omnibus Budget and Reconciliation Act of 1986). COBRA and similar state laws give some workers the right to remain temporarily covered by the health insurance they have through their employer in cases where they’d otherwise lose that health coverage — including if they quit their jobs or work fewer hours.

Other options can include purchasing a plan via the Health Insurance Marketplace at HealthCare.gov or directly from a health insurance company or signing up for Medicare or Medicaid.

Health insurers allow people to enroll in a new plan during a limited time window called a special enrollment period if they are losing their previous plan for certain reasons, including because they are:

moving

leaving a job

getting divorced

If you miss out on getting new health insurance during a special enrollment period, you may have to wait for an open enrollment period, which only occurs for a few months each year (for example, from November through January).

Overly limited choices of doctors. More health insurance plans than ever before have narrow networks, meaning they give people a more limited choice of in-network doctors, hospitals, and treatment centers.

A network is considered narrow if it includes 25% or less of the physicians in the person’s area. Usually, health plans with narrow networks have cheaper premiums than health plans that have larger networks.

People who’ve been diagnosed with breast cancer and have health plans with narrow networks may find that their preferred cancer center and doctors are not considered to be in network providers. It may mean having to spend more time and energy searching for providers who accept their health insurance, travelling farther to get care, or paying more to go to out-of-network providers for their care.

“Access concerns, due to very restrictive provider networks, are adding an extra layer of stress on top of everything else people with cancer are dealing with,” said Dr. Chino.

Source: Data from a June–July 2022 survey by Breastcancer.org. Read more about who took our survey.

2. Additional expenses

Three weeks before she was scheduled to start chemotherapy treatments in the spring of 2022, Mindy Hair’s doctor asked her if she wanted to try scalp cooling to potentially help prevent or reduce hair loss. The center where she would be receiving chemotherapy infusions has DigniCap scalp cooling machines, but she would have to reserve one in advance.

Hair, who lives in Davie, Florida, paid $1,425 for the use of the DigniCap machines, with no guarantee of whether her health insurance might reimburse her for some or all of the cost. Most health insurance companies in the United States don’t cover scalp cooling, but there’s a chance that Aetna, Hair’s insurer, might cover it. She won’t know until she submits all the paperwork.

“The out-of-pocket cost was pretty shocking to me. Scalp cooling is something I had never even heard of before my diagnosis. And it was definitely the biggest unexpected expense I had during treatment,” she said. Still, Hair is glad she was given the option. “The thought of losing all my hair was very upsetting to me, and this was a way to take back some control, hold onto some of my dignity, and get back a piece of who I was before breast cancer,” she said.

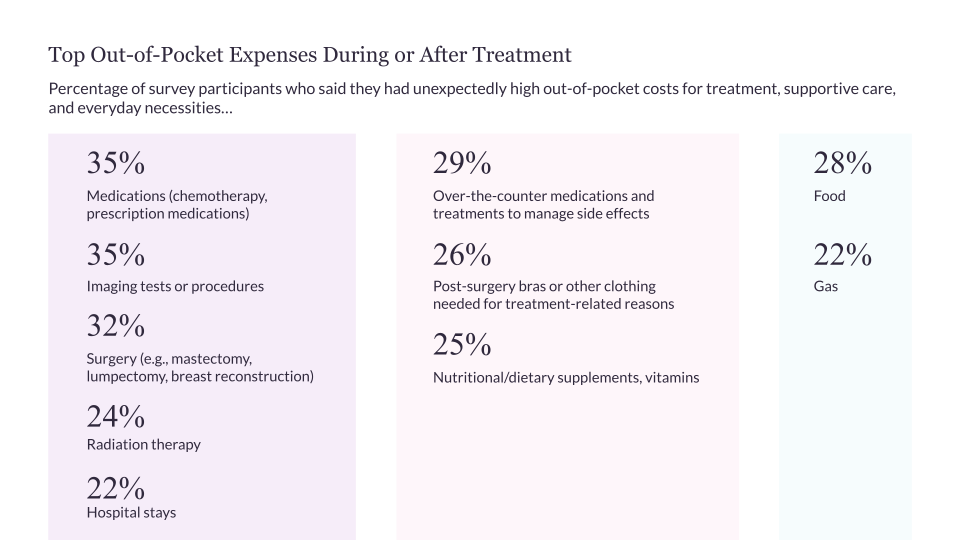

Many of the extra unexpected expenses people have during and after breast cancer treatment are for things that health insurance may not — or doesn’t ever — cover. Some other examples, besides costs for scalp cooling, are:

additional childcare costs (for example, if you have to hire babysitters to care for your children while you are at medical appointments or recovering from surgery or other breast cancer treatments)

additional eldercare costs

additional costs for household help

over-the-counter medicines and supplies to help manage treatment side effects

complementary therapies such as acupuncture, yoga, and massage

wigs, hats, or other head coverings, for those who have treatment-related hair loss

cosmetics for thinning eyebrows and eyelashes or loss of nails

some fertility-preserving treatments

care and treatment for lymphedema (including items such as compression sleeves and garments and seeing specialists for treatment)

post-surgery bras or other clothing needed for treatment-related reasons

supplies you may need while recovering from surgery (including items such as special pillows or a recliner)

“All of those extra costs — whether for childcare during treatment, the drugs that you need to control symptoms, a wig you might need if appearance is important at your job — can add up enough to put people over the edge financially,” said Victoria Blinder, MD, MSc, a medical oncologist at Memorial Sloan Kettering Cancer Center in New York who studies how breast cancer treatment affects people’s employment.

One of the additional costs that nearly all people have is for transportation to medical appointments: either for gas, or for cab, subway, bus, or train fare. Even parking costs can add up significantly. Dr. Chino led a 2020 study that found people pay as much as $800 for parking during a course of breast cancer treatment at some National Cancer Institute (NCI)-designated centers. 7

People who travel out of town for treatment typically have the highest transportation costs and may need to pay for lodging as well.

Cassandra Matthews, who lives in Mobile, Alabama, has been traveling to a cancer center in Birmingham for breast cancer treatment and to participate in a clinical trial about once a month since 2020. It takes her eight hours by car round trip. Initially, the cost of gas was a strain for Matthews and she couldn’t afford to stay in a hotel in Birmingham overnight, even though it would have made the trip much less stressful for her.

“It was very difficult driving home at night after my appointments. My vision is not that good at night. I was so anxious before each trip that I couldn’t sleep,” she said.

Matthews did some research online and found the Lazarex Cancer Foundation, a non-profit organization that provides financial assistance with travel costs to people who are participating in clinical trials for cancer therapies. She applied for assistance, and now the foundation reimburses her expenses for gas, parking, and to stay in a hotel when she travels to Birmingham. “That help has relieved me financially and emotionally,” she said.

Source: Data from a June–July 2022 survey by Breastcancer.org. Read more about who took our survey.

3. Prescription drug costs

People diagnosed with breast cancer often have trouble covering the costs of the prescription medicines they need, even if they have health insurance.

People with health insurance typically have higher out-of-pocket costs (such as higher co-payment and co-insurance rates) when they fill a prescription for a cancer medicine than for other types of drugs. Cancer drugs that tend to cost the most are typically newer, brand-name oral medicines that you take by mouth at home, which aren’t available as more affordable generics or biosimilars. 8 If your health insurance plan has a higher deductible and out-of-pocket maximum limit, you may have to pay hundreds or thousands of dollars out of pocket for your prescriptions each year.

“There is such a wide variation in coverage. For example, for certain oral medications for breast cancer, depending on the insurance plan you have, you may be paying anywhere from zero to thousands of dollars a month out of pocket for your co-payment for that one drug,” said Dr. Blinder. “That’s one of the things that I think is really broken about our healthcare system.”

When people have high out-of-pocket costs for medicines, they are more likely to delay filling a prescription, not fill it at all, or take less medicine than prescribed. 9

One reason this is a problem is that some people take certain medicines for a number of years to lower the risk of breast cancer recurrence. For example, people diagnosed with hormone receptor-positive breast cancer who finish initial breast cancer treatment usually need to begin a five- or 10-year course of tamoxifen or one of the three aromatase inhibitors to lower the risk of recurrence (the cancer coming back).

“The price of prescriptions may feel more real to people than other medical costs, because you need to pay for your prescriptions upfront. You can’t take your medicine home from the pharmacy unless you pay for it, and you can’t negotiate a payment plan after the fact,” said Stacie Dusetzina, PhD, associate professor of health policy and an Ingram Associate Professor of Cancer Research at Vanderbilt University Medical Center in Nashville, Tennessee.

In some cases, people can:

use a manufacturer’s coupon or discount card to get a lower price on a medicine

get help paying for their medicines from non-profit organizations or from a pharmaceutical company-run patient assistance program

It’s important to know, however, that not everyone who is having trouble paying for their medicines is eligible for these discounts or programs.

Out-of-pocket costs can be especially high for people who have Medicare Part D

Medicare is the federal health insurance program that covers people ages 65 and older and certain younger people with disabilities. Currently, 48 million people are enrolled in plans that provide the Medicare Part D drug benefit. Part D plans are offered by private health insurance companies under contract with Medicare.

People diagnosed with cancer who have Medicare Part D prescription drug coverage have been particularly vulnerable to having high out-of-pocket costs for oral cancer drugs because there has been no upper limit on the amount they have to pay out of pocket each year.

“Medicare Part D beneficiaries are the only insured group in the [United States] that have not had a limit on what they pay out of pocket for their medications,” said Amy Niles, executive vice president of the PAN Foundation, an organization in Washington, D.C., that helps underinsured people with life-threatening, chronic, and rare diseases get the medicines they need.

Some people with Medicare Part D who have a low income are eligible for Medicare’s Low-Income Subsidy (also called the Extra Help program), which reduces the out-of-pocket costs related to their prescription coverage. Unfortunately, a lot of the people who are eligible don’t know about the program and don’t enroll. And there are many others who could use the help but don’t meet the eligibility requirements.

Dr. Dusetzina led a study that showed 30% of prescriptions for cancer medicines that doctors write for people who have Medicare Part D and no low-income subsidy never get filled. 10

“We’re seeing that high costs are leading some people with Medicare Part D to forgo necessary care,” said Dr. Dusetzina. “The stress and burden of not being able to afford a treatment your doctor has recommended is substantial.”

Allison (name changed to protect privacy) was diagnosed with metastatic breast cancer in 2021. Her doctor prescribed a combination of two medicines: Verzenio (chemical name: abemaciclib) and Femara (chemical name: letrozole) which, she says, has been working “exceptionally well” for her.

Even with her Medicare Part D coverage, Allison still has to pay $10,900 out of pocket for the Verzenio prescription she filled in 2022. She was deemed ineligible to receive help from a foundation or a pharmaceutical company patient assistance program this year because her household income was considered too high. And since she has Medicare, she also is not eligible to use the manufacturer savings card that some people with commercial health insurance can use to save on out-of-pocket costs when filling a Verzenio prescription.

“The problems people are having with their Medicare Part D coverage come up in my breast cancer support group all the time,” Allison said. “For those of us with metastatic breast cancer, these are ongoing problems because we’re going to have to be on prescription medication for the rest of our lives.”

Fortunately, some relief is on the way. In August 2022, President Joe Biden signed the Inflation Reduction Act into law. The new bill has the following provisions:

Out-of-pocket costs for medicines for people with Medicare Part D are limited to no more than $2,000 a year starting in 2025.

People with Medicare Part D won’t have to pay large amounts during certain months anymore. Starting in 2025, people can spread their out-of-pocket costs throughout the year.

As of 2024, people with Medicare Part D whose out-of-pocket costs reach the catastrophic threshold are no longer still responsible for 5% of their prescription drug costs, with no limit. The catastrophic threshold was set at $7,050 in 2022.

Starting in 2024, people with incomes between 135% and 150% of the federal poverty level are eligible to receive full benefits under Medicare’s Extra Help/Part D Low-Income Subsidy program.

The federal government is required to start negotiating prices for some of the most high-cost drugs covered under Medicare. People with Medicare can have access to newly negotiated prices for selected drugs starting in 2026.

Starting in 2023, drug companies are required to pay a rebate to the government if prices for drugs used by people with Medicare rise faster than inflation.

Annual increases in Medicare Part D premiums are limited to no more than 6% a year from 2024 to 2030.

“The Inflation Reduction Act will have a very significant impact on lowering out-of-pocket costs for people on Medicare, which will mean that more people will be able to start and stay on treatment,” said Niles. “It will bring about huge positive changes and it just makes good policy sense.”

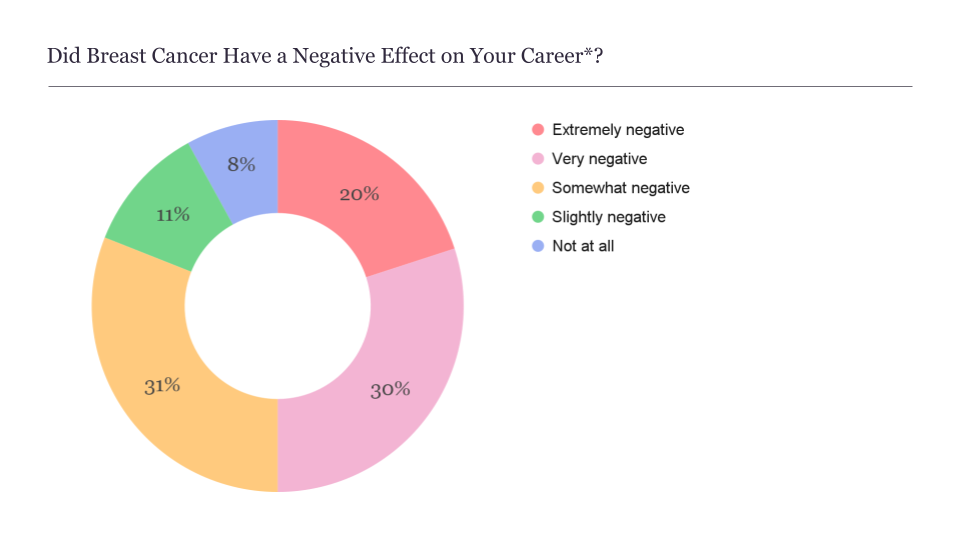

4. Income and job loss

While receiving treatment for breast cancer and kidney cancer in 2021, Nicole Martinelli was able to hold onto her full-time job as an instructor at a private university. It wasn’t always easy, though. She lost about $20,000 — a third of her income — because she took some unpaid leave. There were days when she dragged herself to work when she was feeling sick from chemotherapy because she couldn’t afford to take more time off.

“There are a million emotions you go through after a breast cancer diagnosis, and my biggest frustration was making sure I could keep my job because I need to keep my health insurance. I feared that if I went through cancer treatment without health insurance, I would never financially recover,” Martinelli said.

People who want or need to keep working after a breast cancer diagnosis often find it challenging to manage their job and maintain their income. They may need to take some time off from work for medical appointments, tests and treatments, recovery after surgery, or because they are unable to work because of treatment side effects. Some people need shorter spans of time off or to switch to a part-time work schedule, and others need to take months off. And some may be unable to return to the job they had before they were diagnosed because they have lasting physical or cognitive problems or ongoing intensive treatment. Studies show that about 20% to 30% of people with breast cancer do not return to work within the first four years of being diagnosed. 11

There are local, state, and federal laws that provide protection to some categories of workers who need to take time off from their jobs or require other accommodations at work because of illness or disability. One example is the Family and Medical Leave Act (FMLA) and similar state laws that give certain employees who have serious health conditions the right to take up to 12 weeks of unpaid leave per year without losing their job or health benefits. Employers also have their own policies about leave and other benefits that are available to employees who are dealing with an illness — some more generous than others. Usually people who are self-employed, work part-time, or are gig economy workers have fewer legal protections and benefits available to them if they develop a serious illness than those who have full-time jobs.

Sorting out the details of how to work your treatment around your job — without losing your job — can be confusing, as Martinelli discovered. She had to string together various kinds of paid and unpaid leave during her treatment, including paid personal days off and unpaid leave taken under the FMLA and the ADA (Americans with Disabilities Act). Martinelli and her doctors had to fill out paperwork so she could apply for unpaid leave.

“It was tricky navigating the situation. I had to manage when I took time off very carefully. For example, I scheduled my surgery during my vacation because otherwise I would have run out of the FMLA leave time while I was recovering,” she said.

Patient advocates say that even though there’s more awareness among employers about the rights and needs of workers with serious health conditions than in the past, workplace discrimination still happens. Employers sometimes make it hard or impossible for people receiving treatment for cancer to keep their jobs.

Megan Rizzo-Canny said she has heard from a number of other women in her home state of New Jersey who, like her, were fired and lost their health insurance coverage while they were receiving cancer treatment.

“I think what happens sometimes is [that] the employer is rolling the dice to see if you’ll sue. They’re hoping that you’re not well enough and you’re too embarrassed to fight back,” Rizzo-Canny said.

Rizzo-Canny fought back by finding a law firm that would take on her case on a no win, no fee basis and sued her former employer. Rather than charge her legal fees, the law firm agreed to take a percentage of the settlement if they won the case. Her lawyers negotiated an out-of-court settlement that allowed her to keep her employer-provided health insurance for a few more months and helped her get access to disability insurance benefits that provide income for her family.

“I felt betrayed. It was hard to accept being let go from a job I put so much time and effort into,” said Rizzo-Canny, who now focuses on doing outreach to support others who are living with metastatic breast cancer as a Living Beyond Breast Cancer Hear My Voice Advocate.

*Data reflects the responses of 87% of overall survey participants; 13% responded N/A.

Source: Data from a June–July 2022 survey by Breastcancer.org. Read more about who took our survey.

5. Lack of access to financial help and advice

Policymakers and healthcare institutions are beginning to recognize just how many people struggle to pay for breast cancer care. However, most of the people we spoke with said they had a hard time finding support navigating their financial challenges.

One reason people may feel alone in dealing with costs is that they can’t count on their healthcare providers to help. Patient surveys show that healthcare providers don’t routinely bring up the subject of costs with their patients. For example, a 2020 survey by the non-profit Cancer Support Community found that seven out of 10 people diagnosed with breast cancer said no one from their healthcare team talked with them about the costs of their care. People may be hesitant to bring up the subject, too, because they’re embarrassed or fear they might receive inferior care if they voice concerns about costs.

Most cancer centers and hospitals have financial navigators or social workers on staff who can act as advocates and help people manage care costs and find the best health insurance for their needs. 12 Cancer centers also have ways of identifying people who are experiencing financial hardship. For example, some centers include questions about financial concerns on intake forms. But because of staffing issues and other factors, people who could benefit from financial navigation services don’t always receive them.

For Amy Lynn, who lives in Titusville, Florida, the only practical way of getting help was to find it on her own. After being diagnosed with breast cancer for a second time in 2021, Lynn had to cut back the hours she was working at her part-time job as a virtual receptionist. She struggled to pay for basic expenses such as food and for the gas she needed for the 60-mile round-trip drive to the cancer center where she was receiving treatment.

“I tried getting help from the financial counselor at my cancer center, but she was useless and I gave up on her eventually,” Lynn said.

Lynn looked for resources online and was able to get gas gift cards from Angel Wheels (a program of the non-profit organization Mercy Medical Angels), a free haircut during chemotherapy from a national salon chain, and a wig and makeup from the non-profit organization Sharsheret.

Dozens of national and regional organizations offer financial grants and other types of charitable assistance to people receiving treatment for breast cancer. But they all have different eligibility requirements and application processes. Charitable funds can run out at certain points during the year, and people may need to get on wait lists and keep track of when funds open up again.

“Looking for financial assistance can take up a lot of time and energy,” said Marya Shegog, PhD, MPH, CHES, health equity and diversity coordinator for the Lazarex Cancer Foundation, which is based in Danville, California.

“The options that are out there for financial support for people with breast cancer all take work to find. That’s a challenge when you are already in a compromised state. Plus, many patients are still working during cancer treatment and they don’t have hours to research all the types of help that might be available,” Dr. Shegog said.

Molly MacDonald of Pink Fund noted that people often have to cobble together multiple sources of support in a way that is almost like putting together a business plan. Such a plan might include asking family and friends for financial help, getting assistance with prescription medicine costs from a pharmaceutical company, getting gas gift cards or grocery gift cards from a hospital social worker, and applying to non-profit organizations for assistance paying medical or household bills.

“All of those kinds of support are needed. But the bigger problems that are causing people with breast cancer to be in these situations can only be addressed through advocacy and through legislation,” MacDonald said.

For people like Amy Lynn and the others we spoke with, the work that goes into trying to stay afloat financially after a breast cancer diagnosis is draining and takes their focus away from trying to heal.

“It’s really hard to advocate for yourself when you don’t feel good. It’s the last thing you want to do for yourself,” Lynn said.

Policy proposals to watch

Patient advocates say that the Inflation Reduction Act is a major step forward in reducing costs for Americans diagnosed with cancer and other serious or chronic health conditions. In addition to lowering out-of-pocket costs for many people with Medicare, the bill is going to extend the availability of lower-priced premiums through 2025 for most people who buy their own health insurance through the Health Insurance Marketplace at HealthCare.gov.

“These are policy changes that the patient advocacy community has wanted for a long time. But we’ll need different laws to fill in gaps and make sure people aren’t left behind,” said Joanna Fawzy Morales of Triage Cancer.

Congress is considering passing other legislation that would make treatment more affordable for people diagnosed with cancer and expand access to family and medical leave. The following bills were introduced in 2021 and 2022:

The Job Protection Act would make more workers eligible for leave under the Family and Medical Leave Act, including those who work part time, those who have been at their current job for 90 days, and those who work for employers of any size (not just larger employers).

The FAMILY Act would provide workers with up to 12 weeks of partial income when they take time off for their own serious health conditions or for caregiving purposes.

The Lymphedema Treatment Act would require Medicare to cover the compression garments and supplies needed for lymphedema treatment.

The Stop the Wait Act would eliminate the five-month waiting period for receiving Social Security Disability Insurance (SSDI) after being deemed eligible. It would also allow those who qualify for SSDI and Medicare to immediately receive the Medicare coverage without a waiting period.

The Metastatic Breast Cancer Access to Care Act would allow people who have been diagnosed with metastatic breast cancer and who have been deemed eligible for SSDI to immediately receive SSDI payments (without a five-month waiting period). It would also allow people diagnosed with metastatic breast cancer who qualify for SSDI and Medicare to immediately receive Medicare coverage without a waiting period.

The Improving Seniors’ Timely Access to Care Act would help protect people who have Medicare Advantage plans from unnecessary care delays by streamlining and standardizing the prior authorization process.

The DIVERSE Trials Act would make it easier for people diagnosed with cancer to participate in clinical trials by removing barriers that keep people of color, older adults, rural residents, and those with lower incomes from being appropriately represented.

Paying for breast cancer care: What I wish I'd known at the start

“That I could negotiate payment plans instead of paying medical bills in full all at once.”

“How a financial navigator could have helped me.”

“That there are drug manufacturer co-pay cards and foundations that can help with the cost of prescription medicines.”

“That the cost of treatment can be reduced by participating in a clinical trial.”

“That some health insurance companies have a deadline for submitting a claim…and won’t pay the claim if you miss the deadline.”

Source: Data from a June–July 2022 survey by Breastcancer.org

Managing financial burdens from breast cancer

Figuring out how to manage your finances after a breast cancer diagnosis can be overwhelming.

If you’re concerned about costs, it’s important to not panic and to not skip any treatments or doctor visits. There are resources available to help you and steps you can take at any point to reduce out-of-pocket costs — whether you’re newly diagnosed, receiving treatment, in long-term survivorship, or living with metastatic breast cancer.

“I’d say that a solid 80% of the time there’s a solution that can be found to a problem you’re having with paying for your care,” said Joanna Fawzy Morales of Triage Cancer. “The challenge is connecting people to the resources that already exist.”

A good first step is to ask your healthcare team and pharmacist any questions you have and to let them know of any concerns you have about your ability to afford your care. Your healthcare team may be able to work with your health insurance company to make sure more of your care is covered, schedule your treatments in a way that is easier to juggle with your job, and find ways to lower your expenses (for example, by prescribing less expensive but equally effective medicine).

Here are some other ways you can find support navigating financial, career, and health insurance issues and make your costs more manageable.

Meet with a financial navigator

The hospital or cancer center where you’re receiving your care may have a financial navigator whose job is to help people manage costs related to cancer. The person in this role can also be called a financial counselor, financial advocate, or oncology social worker. Ask your healthcare team or the main office at your cancer center if there is a financial navigator on staff you can contact. One of the best times to meet with a financial navigator is right after your doctor first presents your treatment plan to you. That way, the financial navigator can help you manage costs right from the start.

At any point during or after your treatment, financial navigators can give you free one-on-one support with:

understanding out-of-pocket costs and what your health insurance plan may cover

finding the best health insurance options and applying for health insurance coverage

tapping into resources within the cancer center for assistance with care costs (such as applying for charity care programs or negotiating payment plans for bills)

working with your healthcare team to see if it’s possible to make any changes to your treatment plan to make it more affordable but equally effective

finding resources and applying to programs to lower the costs of your prescription medicines

understanding your legal rights and your options for taking medical leave from your job and getting disability insurance benefits

finding local and national resources that offer co-payment assistance for treatment costs, premium assistance, and financial assistance for household bills, as well as help with other specific needs, such as getting rides to medical appointments

“We help put in the right supports and interventions to make cancer treatment more affordable for patients, so they are able to focus on their healing,” said Aimee Hoch, LSW, MSW, an oncology financial navigator at Grand View Health in Sellersville, Pennsylvania. “And since many patients are receiving treatment for years, we talk with them about survivorship plans and how we can help heal financial toxicity for the long term. We want them to be able to afford to keep getting their follow-up scans,” she said.

It’s important to know that since there is no national certification program for financial navigators yet, financial navigators at different cancer centers don’t all have the same credentials or level of training.

Your cancer center may not have a financial navigator on staff, or you may need more help than your center’s financial navigator can provide. If either of these situations apply to you, it’s a good idea to contact one of the following non-profit organizations, which provide free one-on-one financial navigation (over the phone and through email) to people who’ve been diagnosed with cancer and their caregivers nationwide:

Ask about hospital financial assistance programs

Most hospitals and cancer centers have a department that assists people who are having trouble paying for their treatment. This department may be called financial assistance, financial counseling, charity care, or it may just be the billing department. You can apply to receive free or discounted medical services through this department. Each hospital has its own eligibility rules. To qualify, you typically need to meet eligibility standards, fill out an application, and provide documentation of your household income, savings and other assets, and health insurance status. Even if you don’t officially qualify based on your income or because you have health insurance, you may still have luck getting financial assistance if you fill out the application and attach a letter explaining why you need help paying for your treatment.

In some cases, instead of giving you direct financial assistance, the hospital may offer a payment plan for your bills or may connect you with other organizations that provide financial assistance.

Even if you’re eligible for financial assistance according to your hospital’s policies, you shouldn’t wait for someone at the hospital to encourage you to fill out an application. A 2019 investigation by Kaiser Health News found that nearly half of non-profit hospital organizations regularly send bills to people who would have qualified for charity care under the hospital’s policies if they had filled out an application.

The non-profit organization Dollar For helps people find out if they are likely to be eligible for hospital financial assistance programs, complete their applications for financial assistance, and follow up to get a resolution.

Consider your health insurance options

Experts say it’s a good idea to check at least once a year if there are other health insurance plans that would meet your needs better than your current health insurance plan. Health plans change from year to year, your needs may have changed (for example, you may be taking different prescription medicines than you were last year), and your options may have also changed based on your age or other factors.

“If you aren’t comparing all of your options, then you might end up in a situation where you’re paying more than you need to or your prescription drugs or the providers you want to see aren’t covered,” said Morales.

Depending on why you’re switching health insurance plans and other factors, you may be able to sign up for a new health plan during:

an open enrollment period: an annual time window when health plans accept new applicants (typically from November through January)

a special enrollment period: a time outside the yearly open enrollment window during which you can apply for new health insurance if you’ve had certain qualifying life events, such as moving, getting divorced, or leaving a job

Here are some more questions you may want to consider:

Can you get better health coverage by switching, for example, to a different plan that your employer offers, a plan a partner’s employer’s offers, a plan via the Health Insurance Marketplace at HealthCare.gov, a plan you purchase directly from a health insurance company, or (if you are 65 or older or qualify because you are receiving Social Security Disability Insurance benefits) a Medicare plan?

Would it be a good option for you to get an additional, supplemental insurance plan that would help cover more of your care? One example is the Medigap plans for people with Medicare that are sold by private health insurance companies.

Are you eligible, based on your income, for any types of subsidized coverage that would reduce your out-of-pocket costs? For example, some people with Medicare are eligible for Medicare Savings Programs and Medicare’s Extra Help/Part D Low-Income Subsidy program. And some people who purchase health insurance through the Health Insurance Marketplace qualify for the premium tax credit and cost sharing subsidies. Another option to look into is whether you qualify to get free or low-cost Medicaid coverage — either through your state’s Medicaid agency or through your state’s Breast and Cervical Cancer Treatment Program.

Whichever health insurance options you are considering, check that the doctors you want to see and the cancer center where you want to receive your care are considered in-network and that the medicines you need are covered.

You can get help comparing all your health insurance options by:

working with a financial navigator or oncology social worker at your hospital or cancer center or contact an organization that offers one-on-one financial navigation such as Triage Cancer or the Patient Advocate Foundation

checking with your company’s human resources department or with your supervisor at work about the employer-provided health plans that are available to you

working with a health insurance broker (it’s important to remember that health insurance brokers work on commission and are not necessarily unbiased sources of information)

If you’re eligible for Medicare, you can get help comparing Medicare coverage options and find out if you qualify for subsidies that would reduce your Medicare costs by contacting your state’s SHIP (State Health Insurance Assistance Program) or The Medicare Rights Center.

Additionally, Triage Cancer offers free guides, worksheets, checklists, and other tools to help you understand and compare your health insurance options.

Learn more about options for insurance coverage and mistakes to avoid when looking for insurance.

Confirm your maximum out-of-pocket costs

People often assume that their healthcare team can tell them what they can expect to pay out of pocket for their breast cancer treatment. The truth is, though, that healthcare providers often do not have an easy way of estimating your out-of-pocket costs.

A better strategy may be to confirm your out-of-pocket maximum for the year with your health insurance company, according to Dan Sherman, founder and president of The NaVectis Group, a consulting company in Grand Rapids, Michigan, that assists oncology providers in implementing financial navigation programs.

Your out-of-pocket maximum is the limit on what you have to pay for covered, in-network healthcare services for the year. It doesn’t include what you spend on your monthly premiums, though.

“The vast majority of people receiving cancer treatment will hit their out-of-pocket maximum for the year, and they shouldn’t have to pay more than that,” Sherman said.

He noted that if your doctors are recommending any tests, procedures, or medicines that your health plan doesn’t cover, they should work with you on filing health insurance claim appeals or otherwise finding solutions so that you don’t have to pay more than your out-of-pocket maximum.

Use your health insurance plan effectively

Every health insurance plan has different rules for how to use your benefits. You can minimize your out-of-pocket costs and get better access to the care you need if you know these rules. As soon as you possibly can after being diagnosed, and each time you change health plans, call your health insurance company and ask the following questions:

Do I need to get prior authorization (also known as pre-approval or pre-certification) for any tests, procedures, or treatments before I receive them?

What’s the time limit for submitting health insurance claims?

Are the healthcare providers I want to work with in network for my health plan?

Does my health plan cover out-of-network care and, if so, how does that coverage work?

How much are my co-pays, co-insurance, annual deductible, and annual out-of-pocket maximum?

If any of my health insurance claims are denied, what is the process and what are the deadlines for filing an appeal? (Triage Cancer offers various resources on how to navigate appeals. The American Cancer Society also offers tips on how to appeal health insurance claim denials.)

Learn more about Managing Your Health Insurance.

If you're having a mastectomy or lumpectomy, read more about questions to ask your health insurance company, surgeon, and financial navigator that could help lower your out-of-pocket costs.

Consider your options for managing your job and taking time off

If you have a job that you don’t want to quit or can’t afford to quit, look into what your options are for continuing to work during treatment and for taking time off. The rights and benefits that are available to you depend on how local, state, and federal laws apply in your unique situation and on your employer’s policies.

You may want to consider researching your rights and the benefits that are available to you before you talk with your employer about how you’d like to manage your job during breast cancer treatment. You can also ask someone you trust to help you. A good place to start is by reading about your employer’s leave policies in your employee manual and talking with a financial navigator or oncology social worker at your cancer center about your options.

“Unfortunately, it does fall on employees who’ve been diagnosed with cancer to figure out what their rights are and what options and benefits they have access to. It’s one more thing on their plate to deal with,” said Joanna Fawzy Morales, Esq. of Triage Cancer. “But you’re much more likely to get access to what you need if you know what your rights are.”

It’s common for people to wind up using a combination of different types of leave (for instance, sick leave, vacation time, and family and medical leave) so they can take time off during treatment without losing their job and potentially maintain some of their income.

Here are a few of the issues to consider:

Should you expect to have to take time off from work for treatment or because of side effects? (This is a good question to ask your healthcare providers.)

Is it possible for you to schedule your treatments around your work schedule?

Are you eligible for leave under the Family and Medical Leave Act (FMLA)? Or

are you eligible for family and medical leave under a state law?

Are you eligible to take leave under the Americans with Disabilities Act (ADA) or a similar state law that might provide you access to time off as a reasonable accommodation?

Are you eligible for other types of reasonable accommodations (adjustments in the workplace that help employees continue to work) under the ADA or a similar state law? For instance, could you change your work schedule, temporarily work part-time, do some or all of your work from home, or take more breaks throughout the day to rest?

What other forms of paid or unpaid leave may be available to you (such as paid time off, sick leave, or co-workers donating their sick leave or paid time off to you)?

Do you already have a short-term or long-term disability insurance policy? If so, when can you start receiving payments? (Disability insurance policies provide you with income when you cannot work because of an illness.)

If you don’t already have a disability insurance policy, can you get disability benefits through a state or federal program (for example, social security disability insurance or supplemental security income)?

Can you expect your employer to hold your job for you while you take leave or receive disability insurance benefits and, if so, for how long?

If you are considering leaving your job or working fewer hours, are you eligible to remain temporarily covered by the health insurance you had through your employer under COBRA or similar state laws?

The following resources can help you learn more about your options:

Triage Cancer offers guides to ADA, FMLA, and state laws related to taking time off from work and to employment rights. The organization also offers information about various types of disability insurance options (including those offered through state and federal programs) and state laws related to disability insurance.

The non-profit Cancer and Careers offers educational materials about the legal rights of people diagnosed with cancer in the workplace, as well as handling discrimination, returning to work, or looking for a job after a cancer diagnosis.

For tips about telling your boss and co-workers about your diagnosis, working during treatment, taking time off, looking for a new job, and taking early retirement, read more about Workplace and Job Issues.

If you are interested in hiring a lawyer or finding free or low-cost assistance for legal issues related to employment, discrimination in the workplace, or accessing disability insurance benefits, Triage Cancer offers a Quick Guide to Legal Assistance and Cancer-Related Legal Issues, and Cancer and Careers offers information on Finding Legal Assistance. You may also want to ask your hospital or cancer center if they have medical-legal partnerships (MLP) that can help you with legal matters. Medical-legal partnerships, which are available at some hospitals, cancer centers, and other healthcare sites, give people free access to legal help for issues that affect financial stability, including housing needs (such as avoiding eviction), accessing public financial assistance programs, and appealing denied claims for benefits.

Try to negotiate your medical bills

If you think you might have trouble paying for any of your medical bills in full or on time, you can always try to negotiate with the billing office of the healthcare provider or hospital. Explain why you can’t afford to pay the bill and ask about options for making the payment more manageable.

You may be able to negotiate a lower overall price, set up an interest-free payment plan, or both.

Talking with the billing office can also help prevent the bill from being sent to collections, which can damage your credit.

“I’ve found that it’s worthwhile to try to negotiate. I recently negotiated some bills for treatments I received two years ago, including surgeries, scans, and complex lab work. I was able to reduce the total amount owed and break it up into smaller payments over the next 12 months by having a frank conversation with the billing department at the hospital where I was treated,” said Loriana Hernández-Aldama, a two-time cancer survivor and founder of the ArmorUp for Life Foundation.

Watch for medical billing errors

Medical bills often contain errors, such as duplicate charges or charges for services you never received. You can avoid overpaying if you check your bills for mistakes and charges that you don’t understand.

Experts recommend that, before you pay any medical bill, you make sure you have received the final explanation of benefits (EOB) statement from your health insurance company (related to the medical service the bill is for). If you have more than one health plan, wait until you have the EOB forms from all of them. Then see if the bill matches the EOB form. If they don’t match, call your healthcare provider’s office and ask why. If there are errors, make sure they are corrected.

A recently enacted federal law called the No Surprises Act, and some state laws, protect consumers against some types of surprise or balance medical bills. These are the bills you receive when your health insurer charges you more for receiving care from an out-of-network provider or facility, even if you didn’t have a choice or a straightforward way of knowing the provider or facility was out of network (for example, when you receive care from an out-of-network doctor while hospitalized at an in-network hospital). It’s helpful to learn about your rights under the No Surprises Act. If you receive a surprise bill that you think is in violation of your rights, you can ask your health insurer to correct it. For more help or to file a complaint about a surprise bill, call the federal government’s No Surprises Help Desk at 1-800-985-3059. You can also file a complaint online.

Consider working with a professional medical bill reviewer

Professional medical bill review services are for-profit companies that can review your medical bills, catch any errors or unfair charges, and advocate and negotiate on your behalf with medical billing departments. They charge a fee but can save you time and money, especially if you have bills that are for large amounts.

The Consumers Union recommends looking for a medical bill review specialist through the Alliance of Professional Health Advocates and checking to make sure the specialist you are considering hiring has credentials from the Patient Advocate Certification Board.

See if you can lower your out-of-pocket costs for prescription drugs

It’s important to never skip or delay taking a medicine your doctor has prescribed because of its cost. Tell your healthcare team and pharmacist if you can’t afford the out-of-pocket costs for your prescriptions. They may be able to find an equally effective, lower-cost medicine that you can take instead. You can also try reducing your out-of-pocket costs by, for example, checking how much your medicine costs at other pharmacies and seeing if you can use manufacturer coupons or discount cards.

Read more Tips for Lowering Medicine Costs.

See if you can reduce your treatment-related travel costs

If costs related to travel for breast cancer treatment are becoming a burden for you, talk with your healthcare team about whether you can switch some of your in-person appointments to video visits or phone visits. You may also want to ask if you can receive any of your care at clinic locations that are closer to your home.

In addition, it’s also worth checking to see if your health insurance covers non-emergency rides to and from medical appointments. Medicaid plans in some states, some Medicare Advantage plans, and some other health insurance plans offer this type of coverage.

Look into additional resources for breast cancer-related expenses

Many national and local non-profit organizations also provide people who’ve been diagnosed with cancer with financial assistance for treatment-related costs, travel and transportation costs, or household bills — each with different eligibility requirements.

Learn more about Charitable Resources for People Diagnosed With Breast Cancer.

National Cancer Institute. Surveillance, Epidemiology, and End Results (SEER) Program. Annual Report to the Nation 2021: Special Topic: Patient Economic Burden of Cancer Care. Available at: https://seer.cancer.gov/report_to_nation/special.html

Centers for Disease Control and Prevention (CDC). Cost-Effectiveness of Breast Cancer Interventions. Available at: https://www.cdc.gov/chronicdisease/programs-impact/pop/breast-cancer.htm

Ramsey SD, Blough DK, Kirchhoff AC, et al. Washington Cancer Patients Found To Be At Greater Risk For Bankruptcy Than People Without A Cancer Diagnosis. Health Affairs. 2013. 32(6):1143-1152. Available at: https://doi.org/10.1377/hlthaff.2012.1263

American Cancer Society. The Costs of Cancer: 2020 Edition. Available at: https://www.fightcancer.org/sites/default/files/National%20Documents/Costs-of-Cancer-2020-10222020.pdf

Health System Tracker. ACA’s maximum out-of-pocket limit is growing faster than wages. Available at: https://www.healthsystemtracker.org/brief/aca-maximum-out-of-pocket-limit-is-growing-faster-than-wages/

American Cancer Society. Out-of-Pocket Spending Limits Are Crucial for Cancer Patients & Survivors. Available at: https://www.fightcancer.org/policy-resources/out-pocket-spending-limits-are-crucial-cancer-patients-survivors

Lee A, Shah K, Chino F. Assessment of Parking Fees at National Cancer Institute–Designated Cancer Treatment Centers. JAMA Oncology. 2020. 6(8):1295-1297. Available at: https://doi.org/10.1001/jamaoncol.2020.1475

National Cancer Institute. Cancer Trends Progress Report. Financial Burden of Cancer Care (Updated April 2022). Available at: https://progressreport.cancer.gov/after/economic_burden

Neugut AI, Subar M, Wilde ET, et al. Association Between Prescription Co-Payment Amount and Compliance With Adjuvant Hormonal Therapy in Women With Early-Stage Breast Cancer. Journal of Clinical Oncology. 2011. 29(18):2534-2542. Available at: https://doi.org/10.1200/jco.2010.33.3179

Dusetzina SB, Huskamp HA, Rothman RL, et al. Many Medicare Beneficiaries Do Not Fill High-Price Specialty Drug Prescriptions. Health Affairs. 2022. 41(4):487-496. Available at: https://doi.org/10.1377/hlthaff.2021.01742

Blinder V, Eberle C, Patil S, et al. Women With Breast Cancer Who Work For Accommodating Employers More Likely To Retain Jobs After Treatment. Health Affairs. 2017. 36(2):274-281. Available at: https://doi.org/10.1377/hlthaff.2016.1196

de Moor JS, Mollica M, Sampson A, et al. Delivery of Financial Navigation Services Within National Cancer Institute–Designated Cancer Centers. JNCI Cancer Spectrum. 2021. 5(3):pkab033. Available at: https://doi.org/10.1093/jncics/pkab033

This content is supported by Gilead Sciences, Inc., Lilly, and Pfizer.